Tokenize.

Fractionalize.

Revolutionize.

Connect with our team now to explore how romooz platform can revolutionize your business!

Tomorrow's tech. with today's convenience

Romooz is a SaaS platform that offers a complete solution for real estate tokenization and management on-chain. We do this by leveraging web3 capabilities while maintaining the convenience of web2 user experience that we all love.

By doing this, players in the real estate ecosystem can maximize the efficiency of the fund raising process, avail more services and features to their investors (e.g. secondary market), and open the door for multiple use cases that the web3 technology may offer in the future.

Software-as-a-Service (SaaS)

Fast deployment, low cost, and continuous improvement. Your transition to web3 with romooz has never been easier

One-Stop-Shop from Issuance to Exit

A complete solution for tokenizing your real estate assets and managing the investment journey from issuance to exit

Web2 Experience on Web3 Infrastructure

Utilizes the capabilities of web3 technology (blockchain, tokens, smart contracts) while maintaining the familiar web2 user experience

Tailored to the

Real Estate Ecosystem

Built for the real estate ecosystem addressing its needs and its key players including developers and investment funds

Tokenization & Fractionalization

Enabling traditional businesses to bring their RWA on-chain and fractionalize them into smaller units

Primary & Secondary Markets

Sell new assets and allow current asset owners to trade their fractions with minimum friction

Traditional & Crypto Payments

End users can use traditional payment methods without the need to worry about how web3 works

Built-in Regulatory Compliance

Compliance with local regulations governing digital assets, and adherence to KYC/ AML requirements.

Who is it for?

Romooz can tokenize various types of real estate assets, including residential, commercial, and industrial properties, as well as portfolios containing multiple asset types. It serves two key players in the real estate ecosystem.

1

Real Estate

Developers

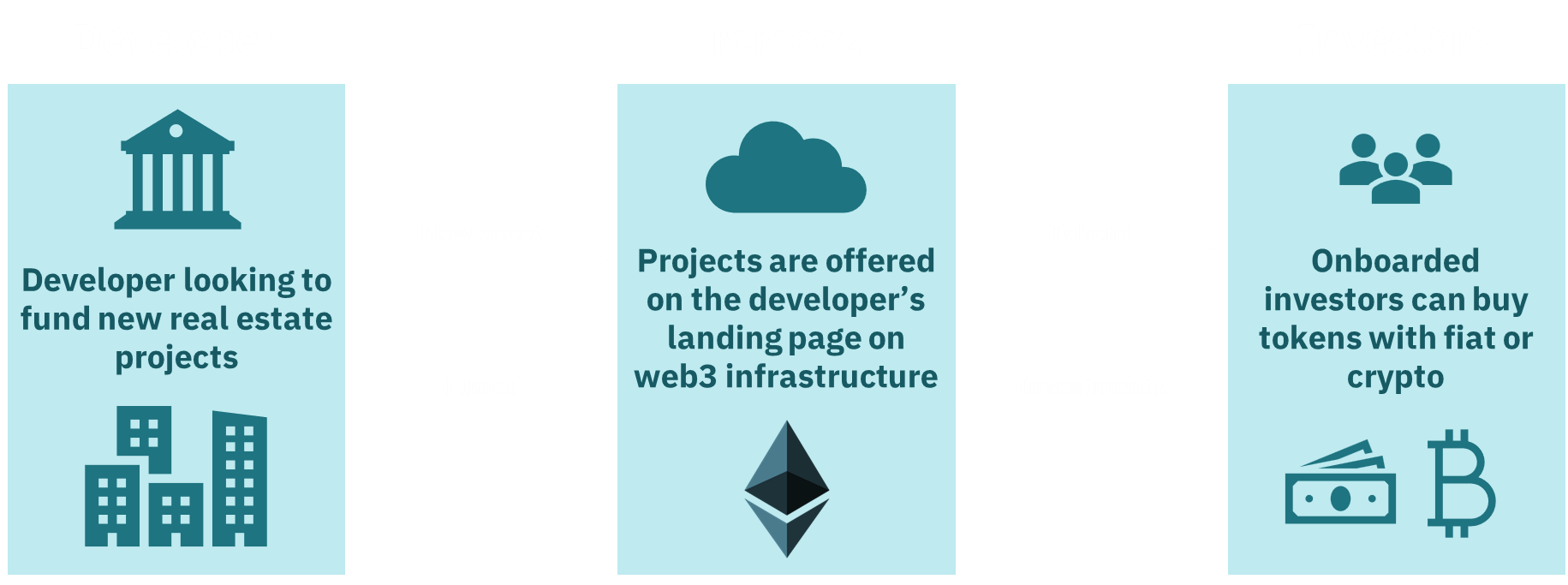

Real Estate Developers often face challenges in financing new developments due to lengthy processes and high capital requirements. Romooz can help them by enabling fractional ownership, allowing developers to raise funds more quickly and directly from a wider pool of investors. They also benefit from automated compliance and streamlined investor management through smart contracts.

2

Real Estate

Investment Funds

Romooz can help the Real Estate Investment Funds by providing them with greater flexibility in structuring investment opportunities, allowing them to sell fractional interests in real estate assets to attract different types of investors. This liquidity and improved portfolio transparency can increase the attractiveness of their offerings and enable quicker capital reallocation.

Example

"Real Estate Developers" can use romooz to fund their projects

Connect with our team now to discuss how romooz can improve your business.

Is tokenization right for you?

"Tokenization can fundamentally change the way we invest, own, and share assets, providing the groundwork for more dynamic and responsive financial markets", Goldman Sachs

16T

$16 Trillion projected global market size for tokenized assets by 2030

Recent study by BCG & ADDX

97%

97% of asset managers agree that tokenization will revolutionize asset management

Survey conducted by BNY Mellon

91%

91% of asset managers are interested in tokenized products

Survey conducted by BNY Mellon

Real estate asset tokenization is the process of converting ownership of a property or a portfolio into digital tokens recorded on a blockchain. These tokens represent fractional shares of the property, allowing investors to buy and sell them on the platform.

Tokenization brings a whole new set of capabilities

Fractionalization

Tokenization divides real estate assets into smaller, tradable units, enabling fractional ownership. Investors can buy portions of high-value properties, opening up opportunities for smaller investors and diversifying portfolios.

Programmability

Smart contracts automate tasks such as compliance checks, revenue distribution, and buybacks, reducing administrative costs and ensuring accurate execution of investor agreements. This creates more efficient property management.

Transparency

Transactions involving tokenized real estate are recorded on a blockchain, creating an immutable and transparent record. This builds investor trust and reduces potential for fraud by providing verifiable transaction histories.

Accessibility

Tokenization allows global investors to participate in markets previously constrained by geography or regulation, creating more inclusive investment opportunities and broadening access to real estate assets.

Liquidity

Tokenized real estate can be traded on secondary markets or specialized exchanges, increasing liquidity for properties that are typically illiquid. This simplifies buying and selling real estate shares, making transactions quicker and more frequent.

Quick Settlement Time

Traditional real estate transactions may require weeks for settlement due to intermediaries, paperwork, and regulations. Tokenization speeds up transactions through smart contracts, automating terms and reducing delays. Settlement occurs in minutes or hours, providing quicker access to funds.

Traditional vs. Tokenized Model

| Traditional | Tokenized | |

|---|---|---|

| Accessibility and Liquidity | Real estate investments often require significant capital and are highly illiquid due to prolonged sales processes. | Tokenization allows investors worldwide to access and trade real estate tokens quickly, making real estate more liquid and accessible to a broader range of investors. |

| Ownership Transfer | Ownership is transferred through a cumbersome and time-consuming process involving legal documentation, title checks, and government registrations. | Property ownership can be transferred almost instantly through smart contracts and the blockchain ledger, enabling transparent and secure transactions. |

| Availability and Flexibility | Real estate transactions are often constrained by business hours, public holidays, and the availability of intermediaries, limiting the times when transactions can occur. | Blockchain-based transactions can occur 24/7 through automated smart contracts, enabling investors to trade real estate tokens at any time and from anywhere, significantly enhancing transaction flexibility and availability. |

| Transaction Costs | The transaction costs include broker fees, legal services, taxes, and administrative expenses. | Tokenized transactions on blockchain can reduce intermediary costs and automate legal and administrative processes through smart contracts, reducing overall transaction costs. |

| Regulatory Compliance | Compliance relies on local regulations, often involving varying requirements for different jurisdictions, which complicates international investments. | Blockchain systems can automate compliance checks through programmable smart contracts, ensuring regulatory adherence across multiple jurisdictions. |

| Transparency and Trust | Transactions often lack transparency due to manual processes and require reliance on third parties. | Blockchain provides a transparent, tamper-proof ledger that logs all transactions, increasing trust between parties by enabling independent verification. |

| User Experience | The current system, involving intermediaries and fiat currency, is familiar to most investors and sellers. It has established practices, and many people are accustomed to using it, providing comfort and ease in managing transactions. | User adoption is hindered by unfamiliarity with tokens, wallet management, and security practices. Web3 platforms also face usability challenges as their interfaces and capabilities are still maturing to meet Web2 standards. |

Although tokenization offers many advantages over the traditional model, user adoption is hindered by unfamiliarity with tokens, wallet management, and security practices. Web3 platforms also face usability challenges as their interfaces are still maturing to meet Web2 standards.

Romooz combines the best of both worlds as it is built on web3,

but still provides a complete and seamless web2 experience.

How it works

Simple and intuitive steps to tokenize and manage your real estate assets! Start now with romooz's SaaS platform and offer more opportunities to your investors in no time.

Prepare your asset for tokenization

The property developer should make sure that all necessary documentation and legal requirements are met in preparation for tokenizing the asset (i.e. bringing it on-chain).

Tokenize and fractionalize the asset

Use the romooz platform to create the asset on the chosen blockchain using the selected protocol. Once on-chain, the asset can be fractionalized into multiple tokens (shares).

Launch the asset's primary offering

The asset's primary offering page is enriched with details and images,and necessary documents are uploaded. Once completed, the offering can be published allowing investors to buy fractions in the asset at the set price.

Distribute profits to investors

When profits are made, you can use romooz platform to distribute profits among the investors. All these transactions are done on the blockchain with minimal manual work and intermediaries.

Investors can resell their shares on the secondary market

In addition, investors may decide to resell their shares on the secondary market using our bulletin board, which gurantees safe and compliant transfer of ownership.

Let’s connect

The Future is Here

To provide a complete solution that complies fully with the local regulatory requirements, we ought to focus on certain geographic areas so that we tailor our platform to their requirements. For now, our primary focus is on the UAE market and the GCC region given our understanding of the region, its potential, and the fast growth in innovative technologies such as web3 and the clarity around its regulations.